Many companies – and many accountants – believe that R&D has to be highly technical in order to qualify for tax relief. This is not the case!

Numerous costs that go through the profit and loss accounts can be claimed, including:

- Director and staff costs

- Subcontractors

- Full cost of prototypes

- Share of utilities

- Testing

- Trial volunteers

What's covered:

- An overview of the R&D tax credit scheme is

- A review of the steps to take to complete a submission

Cost:

- £15 per ticket (join as a team)

- Free for Othership premium members

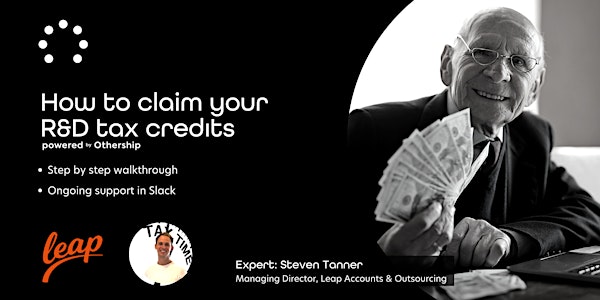

Speaker:

Steven Tanner is an expert in business development, outsourcing and taxation. As the Managing Director of Leap Accounts & Outsourcing and a Chartered Accountant, Steven provides advisory services to tech start-ups and businesses.

Hosted by Leap Accounts & Outsourcing:

Leap Accounts & Outsourcing, experts in business, not just accounting.

Powered by Othership:

Othership • flexible memberships, for flexible working in collaboration with others. Built with remote and hybrid working in mind.

Othership manages this through its network of workspaces, events and collaboration tools. You can join via the web app or request the team to build you a custom solution for your enterprise.

Try a membership for free!